For the last two decades, Sotheby’s and Christie’s have dominated the Chinese auction market, but since the art market downturn in 2008, the wind has changed.

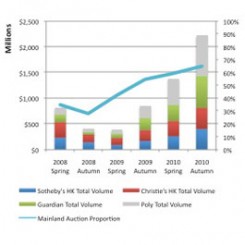

Among the big four auction houses in the Chinese art market—Sotheby’s, Christie’s, China Guardian and Poly Auction—the market shares of Sotheby’s and Christie’s have fallen from 72% in autumn 2008 to 35% in autumn 2010. The total value of the sales from both China Guardian and Poly Auction has increased from $284 million in spring 2008 to $1.21 billion in autumn 2010—an astonishing 498% boost. Sotheby’s and Christie’s went from $534 million in spring 2008 to $813 million in autumn 2010—although a record result, it is still 33% below the total of the two domestic auction companies.

The increasing ambition of the Mainland auction houses can also be seen in the contemporary Chinese auction market, with the market share for China Guardian and Poly increasing from 41% in Autumn 2009 to 56% in Autumn 2010 vis-à-vis Christie’s and Sotheby’s.

Using the data from the auctions has its flaws, partly as the definition of Chinese contemporary art varies between the domestic and the international art market. However, there are clear overlaps between the top selling artists in Hong Kong and in Beijing auctions, which suggest that the two markets are similar at the high end of the Chinese contemporary art market, but differ as we move down to the lower price segments.

Whilst million-dollar prices for Chinese contemporary art have historically been reserved for the Hong Kong market, the last eighteen months have clearly illustrated that this is no longer the case. In the most recent auction season, Poly and Guardian sold 16 contemporary lots above $1 million, for a total value of $39.5 million—against Sotheby’s and Christie’s 12 lots for a total of $20.7 million.

There is no doubt that auctions have become the preferred place to buy art for the growing number of Chinese art investors and buyers. In a rapidly growing art market which is often chaotic and characterised by a large number of smaller players, the size and reputation of the auction houses provide much-needed confidence to many of these new players. The auction process also offers the important price transparency that buyers are looking for.

Now, with such tremendous growth comes the inevitable question of sustainability. Dramatic changes in auction volume often indicate the influx of new, hot money chasing high returns, rather than money looking for aesthetic pleasure. This is a dangerous game as we have seen in markets like neighbouring India. The concept that high prices equal high quality is a particularly fraught one, but becomes the only benchmark when buyers are seeking comfort in the amount of underbidding rather than the intrinsic qualities of the artwork. New buyers in the art market are often blinded by the stratospheric rise in prices, and are buying art not because they believe that it is worth the price, but rather because they believe that they will be able to sell it to someone else at an even higher price. It is the theory of “greatest fools,” and it always ends in tears.

So can it be stopped? Probably not; the current momentum of the domestic art market is too strong. But as we have seen with India’s contemporary art market, this is part of the evolution of an emerging art market—and sometimes the most memorable lessons are the painful ones.